46+ how much of your budget should go to mortgage

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt.

Primary Residence Value As A Percentage Of Net Worth Guide

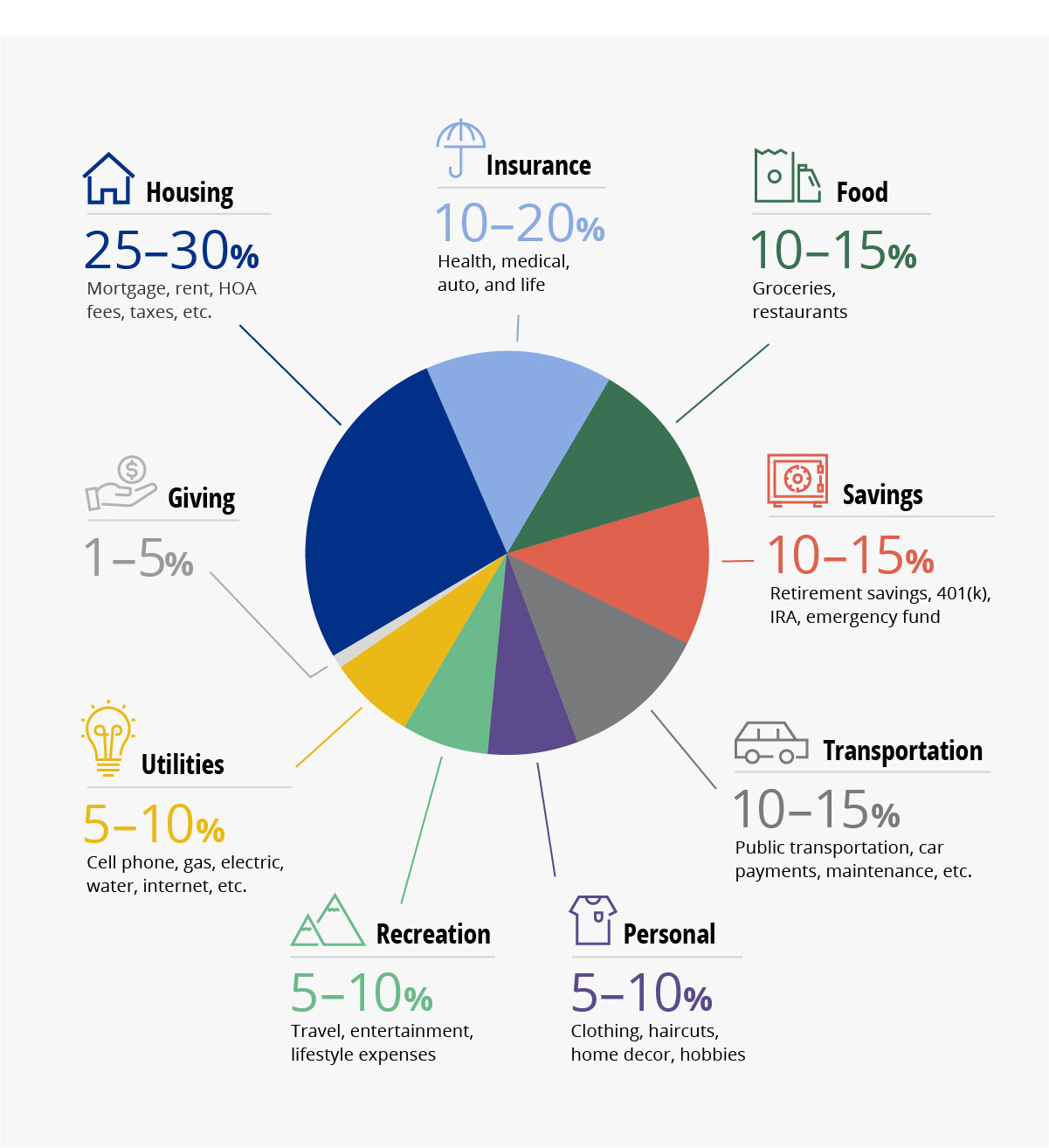

You should set your budget percentages in a way that works best for you.

. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Web One of the best ways to understand how much you can truly afford is to compare your potential monthly mortgage payment to your monthly budget. Ad 5 Best Home Loan Lenders Compared Reviewed.

That includes the principal property taxes. Apply Today Save Money. Web Lets say your monthly mortgage payment is 1000 a month and your other expenses are 1000 so overall your monthly financial obligations come to.

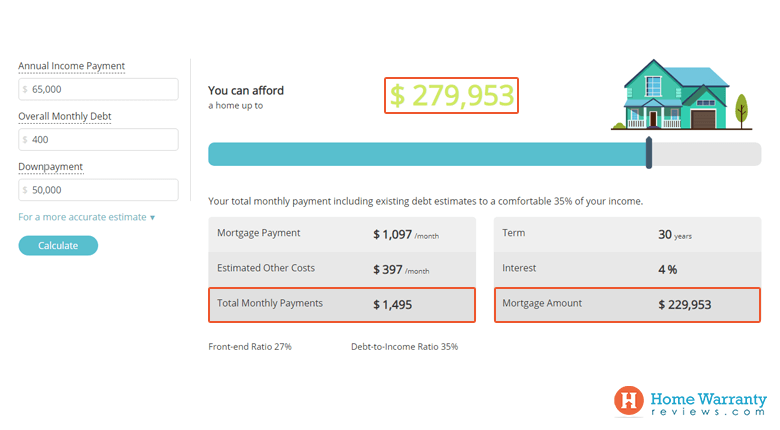

Ad Calculate Your Payment with 0 Down. Web Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use amortization schedule.

The 28 rule The 28 mortgage rule states that you should spend 28 or less. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Looking For Conventional Home Loan.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900. Ad 5 Best Home Loan Lenders Compared Reviewed. Its Fast Simple.

The popular 503020 rule of budgeting. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford.

In that case NerdWallet recommends an annual pretax income of at least 147696. Keep your total debt payments at or below 40 of your pretax monthly. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility. Web If youd put 10 down on a 444444 home your mortgage would be about 400000. Ad See How Competitive Our Rates Are.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. If your anticipated homeownership. Compare Lenders And Find Out Which One Suits You Best.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web According to the 25 rule I mentioned that means your monthly house payment should be no more than 1250. Comparisons Trusted by 55000000.

Compare Lenders And Find Out Which One Suits You Best. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses such as principal interest property taxes heating costs and condo fees. 50000 taxable income 22 tax rate 39000 annual net.

This means that if you want to keep. Comparisons Trusted by 55000000. Web As a general rule your total homeownership expenses shouldnt take up more than 33 of your total monthly budget.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web For instance someone with a taxable income of 50000 a year might take home approximately. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

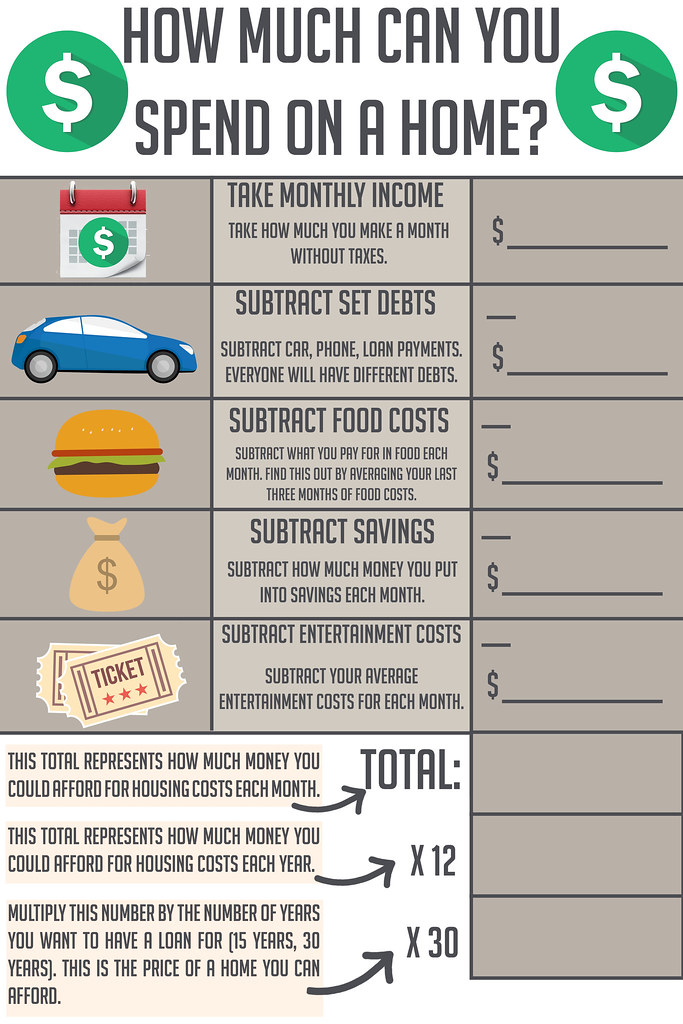

Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Looking For Conventional Home Loan. Web How To Set Your Budget Percentages.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. For example some experts say you should spend no more.

Budgeting Like A Freelancer Set Yearly Amounts And Save The Rest Save Spend Splurge

12531 Wendy Ln Amelia Court House Va 23002 Realtor Com

Calculate How Much To Spend On A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

How Much To Spend On A Mortgage Based On Salary Experian

5 Steps To Buying A Home That Won T Bust Your Budget Ramsey

Income To Mortgage Ratio What Should Yours Be Moneyunder30

The Danish Gas Price Is Around 9 Dollars Per Gallon Why Are Americans So Upset About Paying 4 5 Dollars When It S One Of The Cheapest In The World Quora

Pdf An Analysis Of The Potential Target Market Through The Application Of The Stp Principle Model

Sawmill Rd Ferrum Va 24088 Realtor Com

How Much Of My Income Should Go Towards A Mortgage Payment

Budget Categories 101 9 Ways To Divide Your Budgeting Plan Infographic Fulton Bank

I Was Expressing To My Wife That We Needed To Start Saving Money Or At The Very Least Stop Spending So Much Which Is Mostly Her She Had The Audacity To Tell

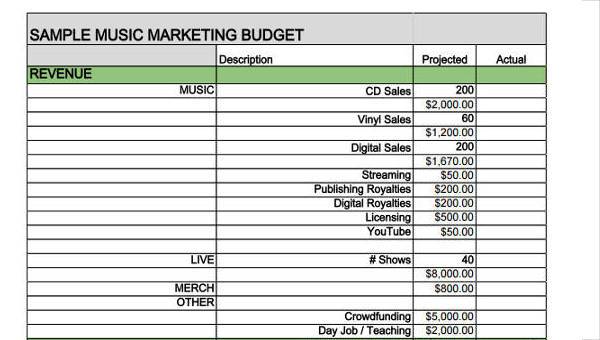

Free 46 Budget Forms In Pdf Ms Word Excel

How Much Can I Afford To Borrow For A Mortgage Homeowners Alliance

![]()

How Much House Can I Afford Interest Com

Home Affordability Calculator