Declining balance method formula

The diminishing balance method is a. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset.

Declining Balance Depreciation Calculator

However in a double-declining balance method of depreciation it will be during the first few years of the assets life that more depreciation expense is incurred.

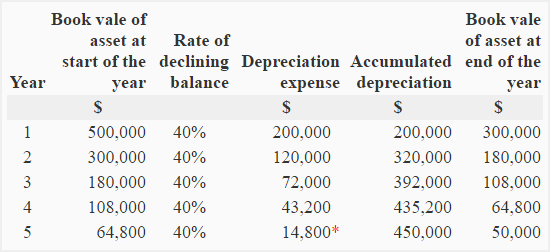

. The book value of the. Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15. Declining balance method is one of the popular technique to calculate depreciation charge that decreases with every successive period.

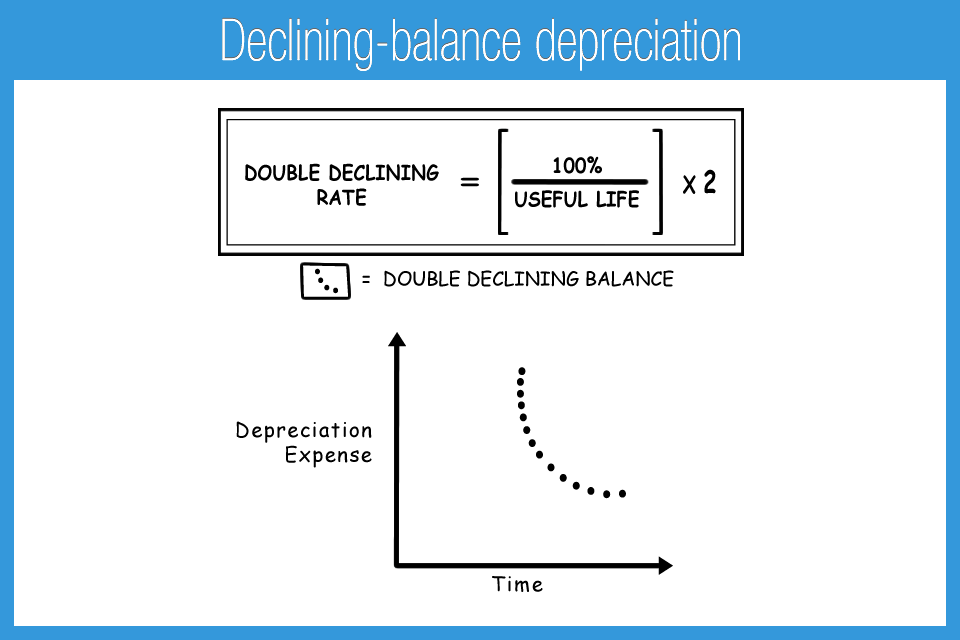

Straight line depreciation rate 15 02 or 20. The formula for depreciation under the double-declining method is as follows. The warehouse would depreciate by 110 or 10 percent each year.

It means that the asset will be depreciated faster than with. Declining Balance Method. The double-declining balance method is a form of accelerated depreciation.

Double Declining Balance Method formula 2 Book Value of. Formula for Double Declining Balance Method. This value is then multiplied by a factor declining.

Double declining balance rate 2 x 20 40. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non. In this case the depreciation rate in the declining balance method can be determined by multiplying the straight-line rate by 2.

As this is an accelerated depreciation method higher. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. Declining balance and reducing is the way how the diminishing balance method is.

They are the straight-line method the diminishing balance method and the units of production method. Depreciation 5 million 1 million 10. Our formula would look like this.

This method depreciates an asset. The double declining balance rate 2 x straight line depreciation rate. The spreadsheet formula in cell A7 shows one divided by the number of years to determine the straight line percentage.

For example if the fixed assets useful life is 5 years then. The formula for calculating depreciation value using declining balance method is Depreciation per annum Net Book Value - Residual Value x Depreciation Rate Net Book. Double-declining balance method.

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

What Is The Double Declining Balance Ddb Method Of Depreciation

How To Use The Excel Db Function Exceljet

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Method Prepnuggets

Declining Balance Method Of Depreciation Formula Depreciation Guru

Double Declining Balance Depreciation Method Youtube

Declining Balance Method Of Depreciation Examples

Simple Tutorial Double Declining Balance Method Youtube

Profitable Method Declining Balance Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Depreciation Formula Examples With Excel Template